Written by Dr. Guy Baker, Founder, Wealth Teams Alliance

Fed Chair Jerome Powell has hinted strongly recently about a potential rate cut in September. No surprise there. Conventional wisdom says lower interest rates are good for the economy because they stimulate economic growth, boost consumer spending, encourage investment, and allocate more capital to reducing debt. The stock market tends to respond positively because cheaper money increases the velocity of money, which in turn boosts corporate earnings and stock prices.

The increased velocity of money also raises total tax revenue, giving the government more money to use toward initiatives that legislators favor. Whether you ascribe to Keynesian (supply-side economic theory) or Austrian School (push-pull theory), the first question is, are interest rates too high? And if they are, are they artificially high or do they accurately reflect market reality?

Looking back over the past century, the prime interest rate dropped dramatically following the tech crash of 2000-2003, then rates rose again, leading to the Great Recession of 2008-2009. Following that period, interest rates dropped dramatically to historic lows again. Then they increased gradually until the COVID downturn in 2020. What happened next? You guessed it. Rates dropped again until 2023, when the U.S. economy reacted to the inflation response caused by the pandemic and rose to where they are today.

As an observer of the economy, what do you think the next phase of economic response will be? Remember, money has no bias or favorites. It will always seek the most efficient outcome. Artificial efforts can try to alter the course of money, but like a powerful river, it will eventually go wherever it wants.

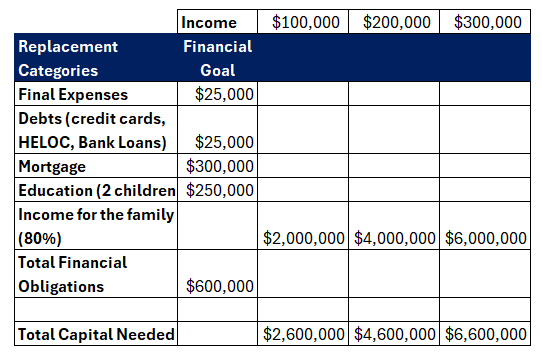

Before answering that question, consider three important factors that should influence the future direction of the economy, markets, and your sense of well-being:

1. Economic Weakness

The Fed cuts rates when it thinks the data reflect a weakening economy. A struggling economy means lower demand for goods and services, which can depress corporate earnings and, eventually, stock prices, even if interest rates are lower. When the economic outlook is uncertain, corporate leaders and investors become more cautious about investing in growth.

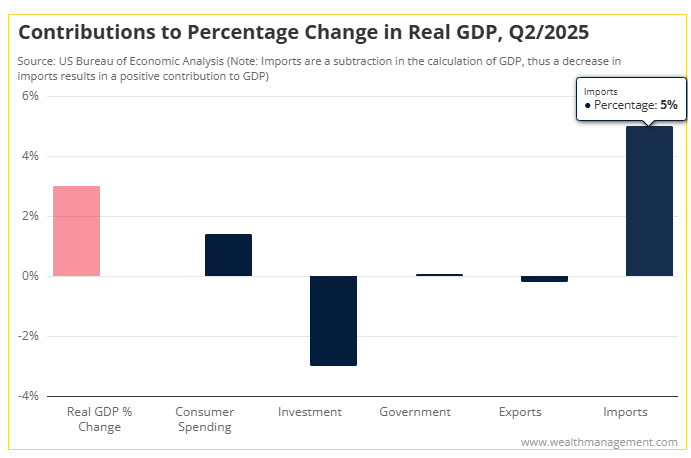

Here is a breakdown of the GDP components for Q2 2025. Remember, this follows a negative 0.5% GDP in Q1 of this year. There is continued weakness in consumer spending and a reduction in investments. Government spending on non-defense and exports was minimal. Imports were the main contributor to GDP growth. In other words, this growth was likely an artificial reaction to the promised tariff increases that are about to be levied. If you remove imports, then GDP was likely negative for Q2, meaning we are in a recession by the traditional definition of two consecutive quarters of negative GDP.

2. Inflationary Concerns

While lower interest rates boost economic activity, they can also lead to higher inflation, which can undermine the effectiveness of those low rates. Add that to the likely inflationary impact of President Trump’s sweeping tariff policy, and it’s hard to imagine a near-term scenario in which rising prices don’t put inflationary pressure on the economy and on consumers. Personal Consumption Expenditures (PCE), which the Fed watches closely, have remained relatively steady over the last 12 months. However, PCE (minus food and energy) is rising. These figures do not anticipate the impact of the coming tariff changes. It is unlikely the Fed would interpret PCE as an argument for lowering rates.

Of course, the Fed also closely watches unemployment data and will take action if rising unemployment is deemed a threat. Unemployment held steady throughout the spring and summer post-Liberation Day, but as we go to press, the monthly Job Openings and Labor Turnover Summary (JOLTS) showed that unemployment outpaced the number of available job openings for the first time since the pandemic era.

3. Market expectations and timing

Investor expectations heavily influence stock prices. For this reason, the impact of a rate change usually begins well before the Fed acts. When investors expect a rate reduction and the economic outlook is good, stock prices rise. Once the Fed implements a cut, the after-effects can be minimal. The exception is when the rate reduction is more (or less) aggressive than investors anticipated. In that case, the market may shift again as investors adjust to new circumstances.

Fed behind the curve (again)?

As a data-dependent policymaker, the Fed relies heavily on recent data to make its decisions. However, since most of the data is dated (and often adjusted) by the time the Fed sees it, rate cuts tend to be reactive rather than proactive, making investing in markets so powerful. Conventional wisdom says that every Fed rate cut over the past quarter century has preceded a recession, but that is not always the case, as we saw in 1995, 1998, and 2021 when we avoided a recession and enjoyed robust gains in stocks (+34%, +26% and +31%, respectively).

Instead of trying to “front run” the data, be the data.” Markets have already priced in true unemployment, inflation, and GDP data before it hits the news or the Fed sees it. Investors using data-sensitive investment methodologies will always be late to the party.

The weakness in the jobs data over the last few months suggests an economic slowdown is already underway. Even so, most sectors of the economy have yet to feel the full effects of the Trump tariffs or the economic slowdown that is in progress. Yet, the Fed is only now preparing for a reactive interest rate cut. The question is, have the tariffs already hit the market?

I’ve often found the Volatility Index (VIX) to be helpful at times like this. Also known as the “fear gauge” of the stock market, the VIX measures market expectations for volatility over the next 30 days, based on the prices of S&P 500 index options. The VIX is a valuable tool for assessing market sentiment, anticipating market movements, and making the next investment decision.

Some say a low VIX is a sign of complacency, and a market shock could cause the VIX to spike rapidly. While the index implies low broad-market volatility, several underlying factors indicate potential risks. For instance, the VIX measures the expected volatility of the S&P 500 index as a whole — it doesn’t account for significant volatility in individual stocks, particularly in the technology (Mag 7) and AI sectors. Also, a low VIX does not mean that all risks have disappeared. Inflation, interest rates, and trade policies continue to evolve, and any unexpected news could easily trigger a shift in market sentiment.

Investing through the clouds of uncertainty

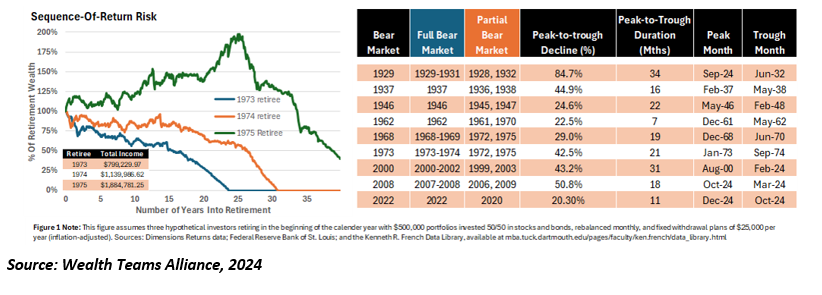

1. For investors with sufficient assets who are nearing (or in) retirement, divvy up the assets between income-producing assets (fixed income, private capital debt, first trust deeds) and equities. Given that market downturns don’t usually last longer than five years, set aside five years’ worth of income in liquid, low-risk fixed income investments. Focus on low-duration risk — lower yields and higher liquidity if interest rates rise. Then invest the equity for long-term growth to cover inflation and longevity risks.

2. For younger investors, consider your time horizon and your attitude toward the long-term outcome of the market. The historic IRR of the S&P 500 is 10.4%. Is there any reason to think that it will change between now and when you retire? Mountains of research show that markets are very predictable over longer time frames. You need to stay focused on the long-term benefits of investing, rather than on short-term risk management.

The challenge is decoupling our emotions from what the evidence shows. It’s easy to get caught up in the short-term noise and think “this time it’s different.” My basic rule is this: “If you are invested, stay invested.” However, with new money, cash, an inheritance, the sale of a business, or other major assets, it’s important to take a long-term view toward allocation. Again, wise investing is a function of age and risk, and then practicing wisdom and caution when handling large amounts of liquidity.